From 2017 to the third quarter of 2018, MLCC soared, bringing about the fluctuation of the whole industry chain and the electronics manufacturing enterprises were severely impacted, as they are the real consumers. The MLCC survey carried out ESMC has presented us a real picture of the feedbacks from electronics manufacturing enterprises.

From 2017 to the third quarter of 2018, MLCC soared, bringing about the fluctuation of the whole industry chain and the electronics manufacturing enterprises were severely impacted, as they are the real consumers. ESMC conducted a survey on the status quo and future trend of MLCC, and itreceived extensive feedback from OEMs, distributors and purchasers. There were 402 copies of effective feedbacks in total, of which more than 70% from the ODM\EMS\OEM terminal manufacturers and brands, and it’s fair to say that this survey can reflect the status quo of MLCC and can make a fair prediction of the future trend.

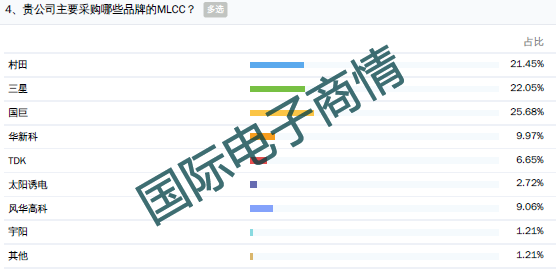

MLCC suppliers are mainly from Japan, Taiwan, Korea and mainland; Murata isthe major player of MLCC industry,together withTDK, and Taiyo Yuden from Japan; Yageo and Walsin from Taiwan; Fenghua hi-tech and Yu Yang from mainland. When asked the question of“Which brands of MLCC do your company mainly choose”, over 20% of the correspondents chose Murata, Samsung andYageo. We see that the option Yageo accounted for 25.68%, and over 9% chose Fenghua hi-tech, which also reflects the transfer of production capacity of MLCC market, the general models of Japanese MLCC opt out consumer electronics market, and steering towards vehicle MLCC; Meanwhile, the application side demand increased exponentially.

Respondents generally believed the MLCC price increase was huge, some claimed to be 3 to 5 times, some said it was 5 to 10 times or even 20 times. Taking 0603 100Vnp SMD capacitors as an example, the purchase price increased by 15 times.

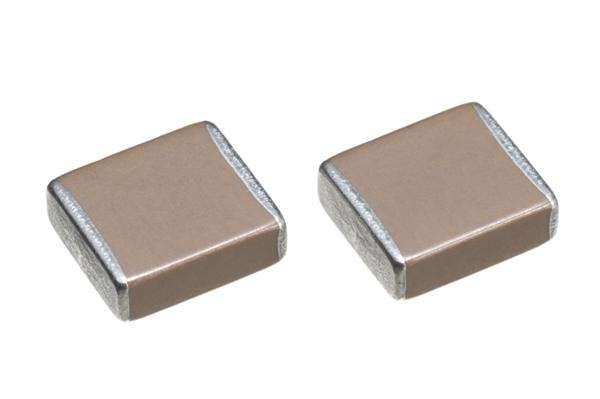

MLCC lowered the price recently, according tothe insiders’ news, the price for spot stockMLCC lowered at the end of last year and early this year (possibly market casting), but soon was pulled back.

According to the survey, 63.24% of the respondents believed MLCC market price was not reduced, but the 24.26% saw the price fluctuations, while another 11.76% believed there was a price cut recently. It also shows that the price cut of MLCC is not a common phenomenon, and it may just be some minor market behavior.

The procurement channels of terminal manufacturers are mainly through the OEMs, distributors, traders and E-commerce platforms. the respondents said that the main procurement channels of MLCC during the stock shortage period were through distributors, followed by traders, OEMs and E-commerce. Distributors remain as the major channel, accounted for 44.78%, while traders ranked second, accounting for 29.13%.

In the survey, we havecollected the information on the revenue size of the electronic manufacturing enterprises, as is shown below, the distribution is quite even: 46% of the companies in survey have the revenue below 300 million yuan; 23% have the revenue between 300 million to 1 billion yuan, while 20% have the revenue between 1 billion to 10 billion yuan.

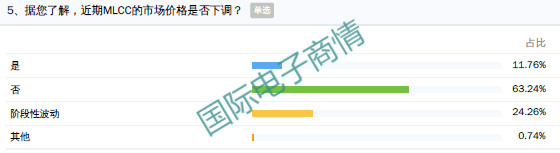

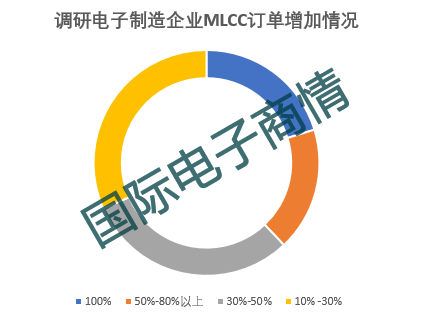

As for the current MLCC stock shortage, up to 83% of the respondents said they have increased MLCC orders, which in fact reflects the increase in inventory. How much has it increased?

According to the feedback, 32% of the respondentssaid MLCC orders increase was between 10 to 30%, and 30% believed the increase was between 30% to 50%, while 18% claimed the increase was between 50% to 80%, and 20% of the respondents said it was doubled. That is to say, more than 60% of the respondentsthought the increase was below 50%, while 38% believed it was more than 50%. How about the actual use of MLCC?

As you can see from the graph below, 52% of respondents said that due to shortage of MLCC, they need to look for alternative devices, and another 35.37% said due to the replacement program, MLCC was used less. As the order was increasing, they were also concerned the MLCC shortage, thus trying to adjust the design to cope the situation.

Although the MLCC stock shortage is prevailing, we can still see that the 73% of the respondents stated that the production was not stopped because of it, while 8% said they had to stop the production, and 19% of them said they had to slow down the production. According to the ESMC analyst, most of the downtime was between one to three days, some respondents also pointed out the downtime could be up to a week due to the materials shortage. More often was the case of production reduction, mainly for 10%-30%, mostly 20%. It can be concluded that no large-scale downtime or production reduction was caused due to MLCC stock shortage.

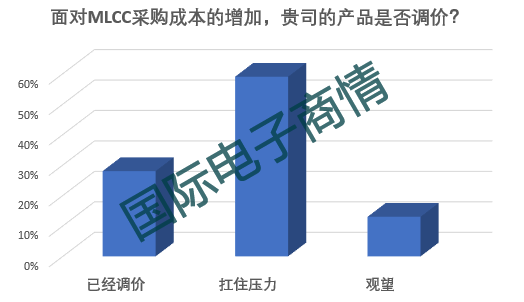

However, due to the fierce competition of the downstream end products, especially due to the price sensitivity of the consumer electronic products, more than 20% of the respondents of electronics companies mentioned they have adjusted the product price; the majority chose to hold pressure, which accounted for more than 60%. This also shows that due to the price increase of MLCCs, profits of terminal enterprises were compressed. Passive components take up about 7% of the whole parts costs, MLCC even less, this may be one reason why enterprises choose not to adjust the price.

As for the future of MLCC is concerned, 25% of respondents said the stock shortage would last until the end of 2019, 22.79% believed it would be until 2020. The MLCC industry has certain precaution and expectation for the future industry chain trend. According to the reports of ESMC on MLCC capacity, MLCC production capacity will mainlybe releasedin 2019 year, and the expansion plans of international manufacturers of MLCC focuses on the compact products.

MLCC stock shortage and the price increase has lasted more than a year. In this survey, respondents also expressed views on the overall trend of MLCC, for example:

※The market is chaotic, the OEMs increase the price without a sound reason; distributors, together with the OEMs and traders, painted the shortage picture.The terminal factories had no access to materials and were forced to buy from traders with higher price. The cost of delivery increased significantly, so did the delivery time, which has brought huge damage to the manufacturers. If this scenario can’t be adjusted, the whole manufacturing industry would have to pay a high price.

※The miniaturization of product transformation 2. car regulatory transformation 3. materials stockdue to panic sentiment 4. Spot suppliers push up the price

※The imbalance between supply and demand;the stock shortage will continue

※The price increase is beyond control

※Bumpy and downward; prices remain high, yet the demand slows down

※Stock shortage and price increase continue

※Slow value return value