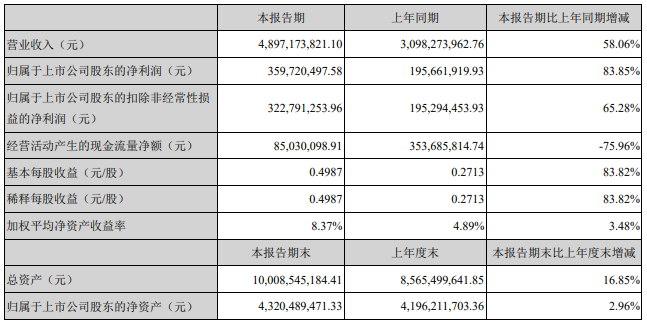

According to ESMC, Shenzhen Huaqiangrecently released the financial report for the first half of 2018, achieving operating income of 4.897 billion yuan, an YoY increase of 58.06%; net profit attributable to shareholders of listed companies of 360 million yuan, up 83.85%. In the investor relations event, Wang Ying, board secretary of Shenzhen Huaqiang, said that the company has continuously integrated resources and opened the market according to the established component distribution strategy. The company has been in the first echelon of the local electronic component distribution industry.

Shenzhen Huaqiang'sbusiness growth in the first half of 2018

In the first half of 2018, Shenzhen Huaqiang continued to actively promote and firmly implement the company's development strategy, and fully enhanced the comprehensive service capability of the modern high-end service industry's entire industrial chain for the electronic information industry, achieving operating income of 4.897 billion yuan, an increase of 58.06%; The net profit attributable to shareholders of listed companies was 360 million yuan, with an YoY increase of 83.85%. The main reason for the increase in operating income and net profit compared with the same period of the previous year was that the scale and profit of the company's electronic component distribution business continued to grow rapidly, which was mainly due to the continued endogenous growth of the business, including the expansion of agent lines, promotion and stickiness of customers, and increase in market share.

Two transformations, fully entering the distribution industry

Since its establishment, the company has been focusing on the electronics industry and has been developing steadily for many years. In the process of development, the company has experienced two strategic transformations, including the transition from traditional electronics manufacturing to modern electronic information services in 2008, and the upgraded strategic transformation based on the high-end service industry of the electronic information industry at the end of 2014. The deep integration of the electronic components distribution industry makes full use of the upstream OEMs and downstream customers, Huaqiang Electronics World, Huaqiang Electronic Network and other related resources to create a trading service platform that runs through the entire electronic information industry chain.

At the end of 2014, the company formulated an upgraded version strategy, which is based on the company's resource endowments and advantages. Based on its rich experience in electronics industry, taking the basic principles of doing business that is familiar, understandable and controllable, after long-term, in-depth, multi-faceted research and careful considerations, we have established a strategic transformation plan for full access to the electronic components distribution industry.

The company's considerations include:

(1) The domestic electronic component distribution industry is in a highly fragmented market, and has great potential for integration;

(2) The electronic component distribution industry is a typical capital-intensive industry. Since its establishment, the company has accumulated high-quality assets. It is a core customer of domestic and foreign mainstream banks, with wide capital channels and low cost.

(3) In recent years, the domestic electronics manufacturing industry has developed rapidly and needs more technologies, capital, products and services to support. Therefore, domestic electronic component distributors have also entered a period of rapid development. This has been verified by overseas counterparts. International distribution industry giants such as Arrow and Avnet are growing rapidly along with the rapid development of their local electronics manufacturing industry.

Since 2015, the company has continued to expand the electronic industry chain in accordance with the established strategy. Through the acquisition of excellent electronic component distributors such as Xianghai Electronics, Pengyuan Electronics, Qinuo Technology, Corefei Electronics, as well asshareholding Hong Kong Qingzhuang, it continuesthe integration of domestic electronic components distribution business. The upstream passive component agent plus active component agent, foreign production line agent plus domestic production line agent have been integrated.A complete and complementary electronic component distribution platform layout of new energy, digital TV, security, automotive electronics, rail transit have been formed.

In industrial integration process, the company has cultivated the best M&A team in the industry, and insists on the acquisition based on the continuous successful experience. The company's currently acquired distribution companies have exceeded their expected performances and accomplished a series of outstanding industry acquisitions. For example, Xianghai Electronics, which was acquired in 2015, completed its performance commitment 13 months ahead of schedule.

Pengyuan Electronics, a subsidiary of the company, talks about the silicon carbide market

Huang Yuru, deputy general manager of Pengyuan Electronics, and Liu Xuechao, Pengyuan electronic technology consultant, analyzed the third-generation power semiconductor market and its agent. Third generation power semiconductors include silicon carbide (SiC) and gallium nitride (GaN). In recent years, with the increasingly high-performance requirements of power electronic devices in emerging fields such as UHV transmission, rail transit, new energy power generation and aerospace, third-generation power semiconductors are expected to play an increasingly important role in power conversion due to it is high withstand voltage, high temperature resistance high frequency, high efficiency, and high radiation resistance. Silicon carbidein particular has huge the market potential. The main application fields include new energy vehicles, photovoltaics, energy internet, smart grid, rail transit and so on.

Pengyuan Electronics, the company's holding subsidiary, is the leading distributor of silicon carbide devices in China. It is the agent of Wolfspeed for its SiC products; In the field of new energy generation, new energy vehicles and rail transit (the third generation of power semiconductor applications), Pengyuan Electronics has a large number of high-quality customers, and the demand for silicon carbide devices in these fields is growing rapidly; Pengyuan Electronics is also striving to build a top silicon carbide device application design team to enhance technology distribution capabilities and taking the lead in the third generation power semiconductor agent distribution field.

The price increase of power devices is mainly affected by changes in supply and demand. Previously, the market forecast of power devices by OEMs was conservative, resulting in insufficient supply, while the demand for power devices increased due to the applications such as electric vehicles and bitcoins.

MLCC price increases, customers value the role of agents to maintain the stability of supply chain

The price of MLCC has continued to increase since 2017, which is due to the structural imbalance between supply and demand. For the MLCC products with the same size, Japanese manufacturers have already produced capacitor values that are ahead of the ones in Taiwan and mainland. By the end of 2016, Japanese manufacturers have developed smaller products with higher capacitance values, resulting in structural shortage of products manufactured before and after the end of 2016 by the Japanese manufacturers, and the impact spread to the products produced by Taiwanese and mainland manufacturers.

Under this context, our company assumed a stable and sustainable role as a large distributor, smoothing the upstream and downstream impacts of the supply chain, and making forward-looking predictions based on years of industry experience and technology, research and other capabilities, guiding customersto make reasonable arrangements for purchasing and inventory according to the supply and demand changes of different components. In the meantime, as a powerful large-scale electronic component distributor, the company relies on its own competitiveness in the field of electronic component distribution, providing comprehensive support to customers in procurement, inventory, logistics, capital, technology and so on. The long-term service guarantee the safety and stability of the customer's supply chain and production, which greatly enhances the customer's stickiness, and consolidates and strengthens the company's market position as the leader. The company is not engaged in short-term businesses that hurt customer relationships and channels.

The distribution of electronic components is an important link between the upstream OEMs and downstream manufacturers in the industry chain. The distributors provide customers with integrated solutions and services, technical support and supply chain services, in combination with the performance of upstream product and the functional requirements of downstream customer terminal products. Due to industry characteristics and the nature of electronic components trading, the distribution model will remain to be the main channel of trading in the long run.

Wang Ying said that the strategic positioning of the company is accurate and clear, and it is highly matched with the its development. The scale effect is remarkable and the company has been in the first echelon of the local electronic component distribution industry. With industry-leading profit level and profitability, the integrated online and offline distribution system, it effectively improves the utilization rate and business development capability of electronic components distribution resources. The online and offline platforms have gathered millions of large and medium-sized SME customers and traders’ resources, over 100 million pieces of supply and demand information, massive transaction data resources, high-end international OEMs resources, numerous domestic small and medimum size OEM resources, and complete set of supporting resources in e-commerce, financing and logistics.