The supply chain of electronic components can be divided into three major parts:OEMs, distributors and buyers. In 2018 annual survey conducted by ESMC on distribution and procurement, we have seen some changes.

Usually, the supply chain of electronic components can be divided into three major components: OEMs, distributors and buyers. Due to demand and value, the relationship among the three is unbreakable. However, subtle changes still exist. In 2018 annual survey conducted by ESMC on distribution and procurement, we have seen some changes, and the outside world will have a new perception about the status quo of the industry.

Distributors and OEMs

Among the questionnaires handed out by ESMC on Electronic Components Distributor in 2018, there were a total of 131 valid feedback questionnaires, mainly focusing on the Chinese market. The gross profit margin of distributors showed a downward trend. 29.85% of the feedbackclaimed the gross profit margin in 2017 was between 10% and 15%, while 25.37% claimed 20%~40%, and 17.91% claimed 15%~20% gross profit margin.

ESMC believes that this is due to, on the one hand, the transparency of the distribution price; on the other hand, the profit is squeezed by the market environment, the end customers force price down of upstream, and the OEMs tightens profits to the distributors. The survival and development of distributors are facing serious issues.

For manufacturing segment, let’s take smartphones as an example. Smartphone shipments are declining and brand concentration is further strengthened. The statistics shows that the smartphone sales have fallen for the first time in both Chinese and global market in 2017, and smartphone sales in the Chinese market has declined for 27% from January to March 2018., and 17.8% from January to June. The demand of smartphone has been weak in the past two years. It may be difficult to get a fundamental change before the release of 5G mobile phone. Samsung, Huawei, Apple, Xiaomi and OPPO are the top five mobile phone brands in the world, accounted for 59.9% of the total market in Q2 in 2017 and 66.8% in Q2 in 2018. The top five mobile phone brands in the Chinese market are Huawei, OPPO, Vivo, Xiaomi and Apple. Their total market share was 67% in 2016, and in 2017 it went up to 77%. Obviously, the market share of other mobile phone brands is decreasing, and shipments of top brandsare more concentrated.

This situation is bound to affect suppliers, the leading or strong suppliers may get more market opportunities, and some suppliers are impacted by the decline of customer shipments. This also allows distributors to join forces, to combine, or to take actions with the help of capital.

The large-scale mergers and acquisitions of upstream factories were not as smooth as expected. For example, both the acquisition of Qualcomm by Broadcom and Qualcomm's acquisition of NXP failed. Despite this, small-scale merges and acquisitions are still taking place. For example, Lite acquired IXYS, Renesas acquired IDT etc., while the integration of product line implies the change of channel, and the distributors wouldhave to face more changes. The concentration of semiconductor companies and their distributors will be inevitable for a long time to come.

The distributors arefacing many scattered challenges. We see that market demand weakening, demand changes getting fast, profit margins falling, customer payment recovery being difficult, the OEMs management strategy changing, exchange rate fluctuating, and inventory pressure tensing. The factors are evenly scattered.Opening up new application markets and customers is the top priority for distributors.It includes increasing product categories, strengthening relationships with suppliers and buyers, a setting up additional offices to strengthen corporate services and brand promotion and expanding service coverage.

Source: ESMC

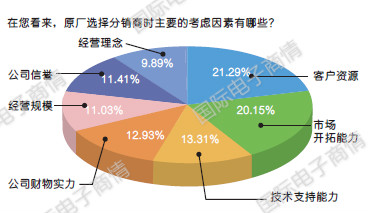

OEMs select distributors based on their customer resources and market development capabilities.

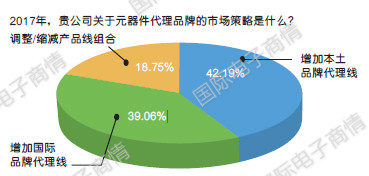

Distributors reflect the selection criteria for the OEMs when the diversified agent line is expanded. In terms of the marketing strategy of the component agent brand, the increase of the local brands line resembles that of the international brands. When distributors choose brands, they mainly consider the reputation of the brand and whether it is complementary to the existing market. They do not care whether the original factory is from domestic or overseas. However, it can’t be denied that the domestic integrated circuit is developing at a faster speed, and the Chinese chips are highly valued by government, the domestic IC will surely gain popularity.

Source: ESMC

The acquisition of the OEMs and shareholding of the upstream by distributors occurred from time to time, although the proportion remained low. According to ESMC, the listed distributors have shown an upward-stretching strategy. For example, Weir Semiconductor's acquisition of Haowei Technology, Wuhan Liyuan and Cogo has shown that distributors’efforts to take control of the upstream resources. By getting close to customers and develop deeper understanding of their demands, distributors have the opportunity to gain more development.

Emerging Markets

Consumer electronics, industrial electronics, and automotive electronics are the three major applications of distributors' sales revenue in 2017. Followed by medical electronics, network and communication systems, and security monitoring. Consumer electronics is undoubtedly the largest distribution market, and industrial electronics and automotive electronics ranked the second and the third. In recent field interviews conducted by ESMC, it has noticed the urgency of distributors moving from consumer electronics fields to other application markets.Automotive electronics is in particular; the demand for semiconductors for PEV will double. It is worth noting that the demand for discrete devices will be up to five times, the consumption of MLCC will increase by six times, and the connector will also increase by 1.6 to 2 times.

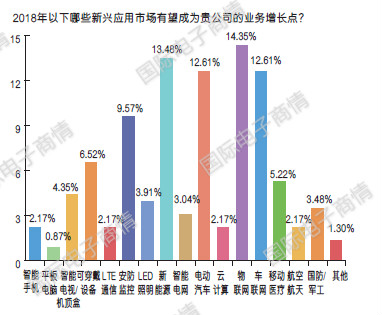

In 2018, the business growth point of distributors was also placed in the automotive-related market, including NEVs, EVs and Telematics, all of which showed a higher proportion in research.

Source: ESMC

Up to 14% chose IoT, which is another major market. In addition, security monitoring and wearable devices takes up more than 5% of choices; traditional consumer electronics such as smartphones and tablets account for a relatively low proportion.As the industrial chains for smart phone and tablets mature, distributors’ profit growth is limited, opening new markets becomes necessary to gain more opportunities.

Distributors’ value

There are three major criteria for qualified distributors, namely, the supply capacity, product price and technical support capacity. The supply capacity ranks first, which also indicates that the smooth supply is critical to customers. Pricingis not the top priority. In addition, other factors like the company's reputation, product quality and capabilities for rapid response closely follow.

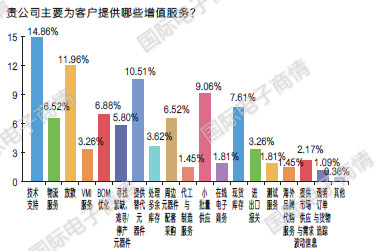

Technical support has become the Number One value-added service that distributors can provide to customers. Loan and replacement components are ranked number second and third, followed by small batch supply and spot stocks. ESMC believes that technical support has become the most important value-added service for distributors at present. The lending and credit period are the classical services; Replacement components can increase distributor’s competitivenessin times of supply shortage. Spot stocks are getting increasingly important; In addition, small batch supply helps distributors to provide better product design period services.

Source: ESMC

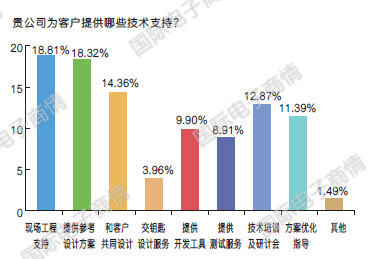

In terms of technical support, on-site engineering support, reference design, and co-design with customers are the top three options, which indicates that distributors are more actively involved in customer design from the very beginning to guide customer's selection and needs.

Source: ESMC

Online Trading

Among the revenue ratios of distributors' online transactions, 32% made the choice of 10% and 0. Online transactions have not been widely adopted by distributors.Certain E-commerce platforms had over 80% online transaction. Currently, it is not rare that E-commerce platforms have 40% to 60% of online transactions, nevertheless, distribution by E-commerce is still weak.

Source: ESMC

The online business is mainly generated by third-party trading platforms, accounting for 59.09%. For online trading development, purchasing habits and mutual trust are still the bottleneck.

The major online services are product inquiry and inventory inquiry. In addition, model inquiry, data service and BOM ordering are also relatively important. It can be seen that the online service is moving from the basic functions such as inquiry to further data and BOM, which is also the starting point of the online service for components.

Procurement

The survey also collected a procurement questionnaire and received 159 valid feedbacks. 36.54% respondents stated that more than 80% of components were purchased through distribution channels, and the majority correspondents stated that the purchase value would increase, so would the proportion of purchases through distribution channels.

The top five criteria of distributors to choose suppliers are product quality, product price, delivery time, supply capacity and payment terms.

Source: ESMC

The main reasons for the downgrade of suppliers include unstable product quality, uncompetitive price and untimely delivery.

When asked with which distributor they would preferto work,some purchasers showed preference on international distributors over local distributors; the rest purchasers didn’t show any preferences.

When purchasing components, purchasers took the following factors as the most important ones:price, supply ability, product quality, payment terms and technical support.

The most desired value-added services that are technical support, finding scarce materials, providing alternative products, and small-batch procurement services. This is positively correlated to the value-added services provided by the distributors.

59% of the respondents would purchase components through the E-commerce platform. They mainly use it to conduct model query, inventory inquiry, product inquiry, small batch procurement and check component specifications.

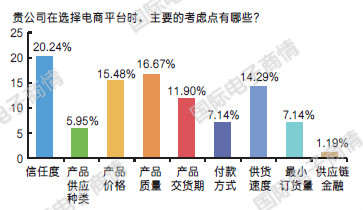

The selection of e-commerce platforms is mainly trust, product quality, price and delivery speed. The trust ranks first, as a matter of fact, “trust” covers its comprehensive performance of the brand, product quality, supplier resources and services.

The preferred approach of reducing costs is to introduce competitive suppliers, or to use common parts instead of customized parts, and to convince suppliers to cut prices, to extend payment cycles or to find alternative materials.

The main channels for component query are via the selection tools using on the supplier's website, with product information provided by existing suppliers or recommended by other suppliers.

In terms of shortening the supply cycle, there are four approaches, namely,maintaining spot stocks for certain long-cycle materials; signing supply agreements with suppliers; forecasting special demands to suppliers and purchasing from the spot market.

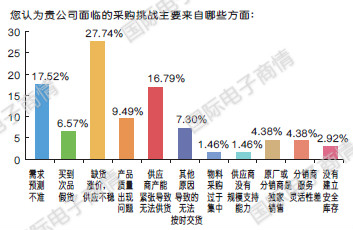

The main procurement challenge comes from the shortage of goods and unstable supply, which accounts for 27.74% of the feedback, followed by the inaccurate demand forecast and the failed supply due to the limited supply capacity of suppliers.

To meet the procurement challenge, we believe that strengthening supplier relations has the priority, followed by the selectionof suppliers with good production resources, adopting multi-brand, multi-vendor strategies, and replacing suppliers with comprehensive strength. It is also generally believed that stock-outs will become the norm.

Source: ESMC